Project Challenge

Objective

The challenge for the Forex trading bot project was to develop a highly responsive and accurate system capable of executing trades automatically based on real-time market conditions. We needed to ensure the bot could process and act on FootPrint trading signals with precision, while incorporating customizable features such as trading hours, dynamic take profit, and trailing stop loss. Additionally, managing multiple trades, reinforcing positions, and avoiding repeated signals in volatile markets presented further complexities. Creating a robust bot that maintains performance under different market conditions was key to delivering a reliable trading solution.

01

Strategy Approach

Approach

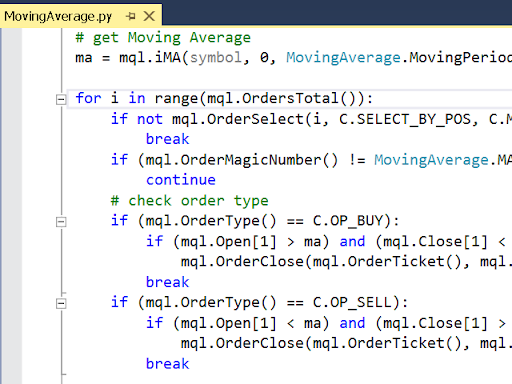

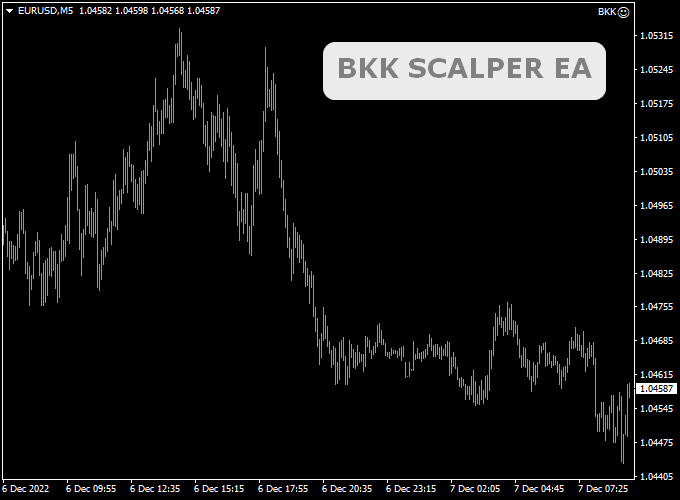

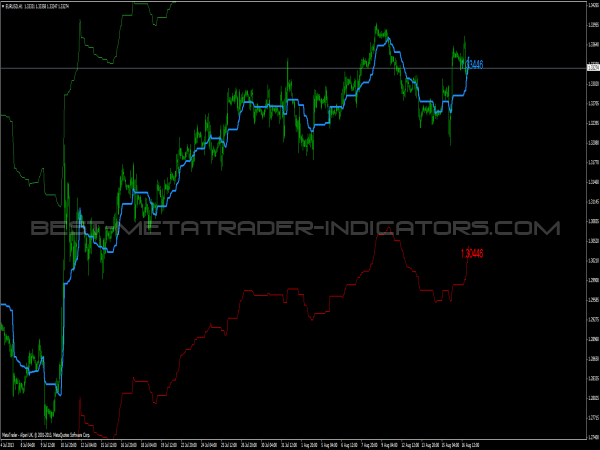

For the Forex trading bot, our strategy approach focused on creating a robust, data-driven system capable of making fast and accurate trading decisions. We utilized the FootPrint chart methodology to analyze market orders, helping the bot identify optimal buy and sell points. The strategy was designed to allow customization, enabling users to set specific trading hours, days, and intervals. Key features like trailing stop loss, dynamic take profit, and signal filtering were incorporated to manage risk and enhance profit opportunities. Additionally, the bot was programmed to reinforce positions if favorable conditions persisted and to avoid entering redundant trades, ensuring it reacts efficiently to new signals in volatile markets. The combination of advanced algorithms and real-time market data was crucial in creating an adaptive, flexible trading strategy that caters to various trading preferences and market conditions.

The Solution

Solution

We developed a sophisticated Forex trading bot that leverages FootPrint chart analysis to execute buy and sell trades automatically based on real-time signals. The bot features customizable settings, allowing users to define specific trading hours, days, and intervals to align with their strategies. It also includes advanced functionalities such as trailing stop loss, dynamic take profit, and signal filtering, ensuring that the bot maximizes profit potential while managing risk. To enhance flexibility, we incorporated reinforcement logic, allowing the bot to open additional positions when market conditions favor the current trade. By avoiding repeated signals and carefully monitoring price changes, the bot ensures efficiency and accuracy in executing trades. The result is a highly responsive, automated trading system capable of handling different market conditions, making it a valuable tool for Forex traders.